With the rise of AI in finance, traders are more and more leveraging AI-driven insights for higher decision-making. This text explores how we are able to create a hierarchical multi-agent AI system utilizing LangGraph Supervisor to investigate monetary market developments, carry out sentiment evaluation, and supply funding suggestions. By integrating specialised brokers for market information retrieval, sentiment evaluation, quantitative evaluation, and funding technique formulation, we allow an clever, automated system that mimics the workflow of human monetary analysts.

Studying Aims

- Be taught hierarchical constructions, supervisor roles, and agent coordination.

- Construct domain-specific, sentiment, and quantitative evaluation brokers.

- Handle agent communication and configure hierarchical workflows.

- Combine AI insights for data-driven suggestions.

- Implement, optimize, and scale AI-driven functions.

- Mitigate biases, guarantee transparency, and improve reliability.

- This module supplies a hands-on strategy to constructing clever, AI-driven multi-agent methods utilizing scalable frameworks.

This text was printed as part of the Information Science Blogathon.

Multi-Agent AI System: LangChain Supervisor

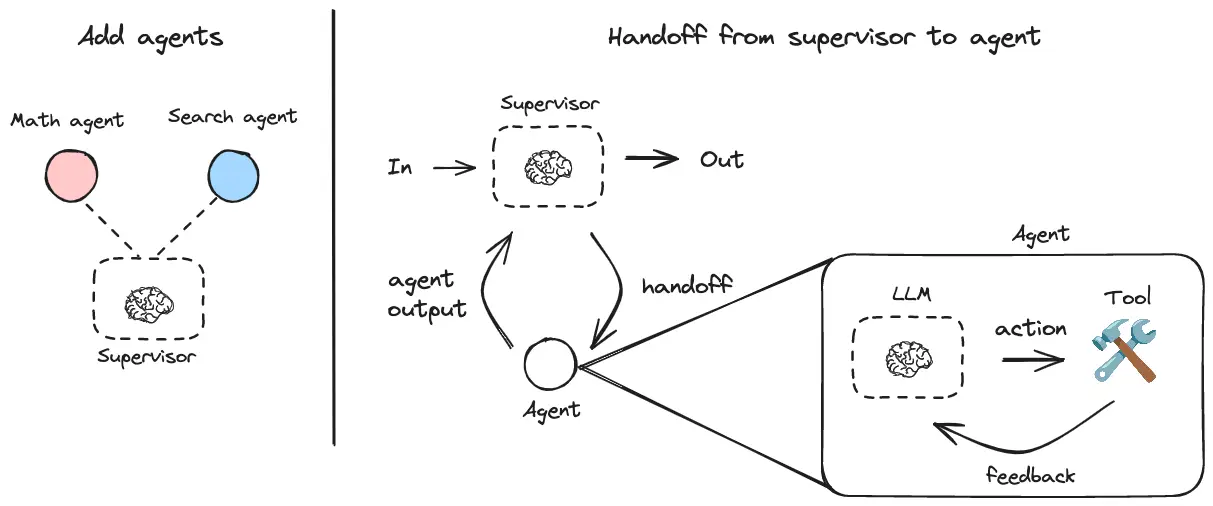

Right here’s a easy instance of a supervisor managing two specialised brokers:

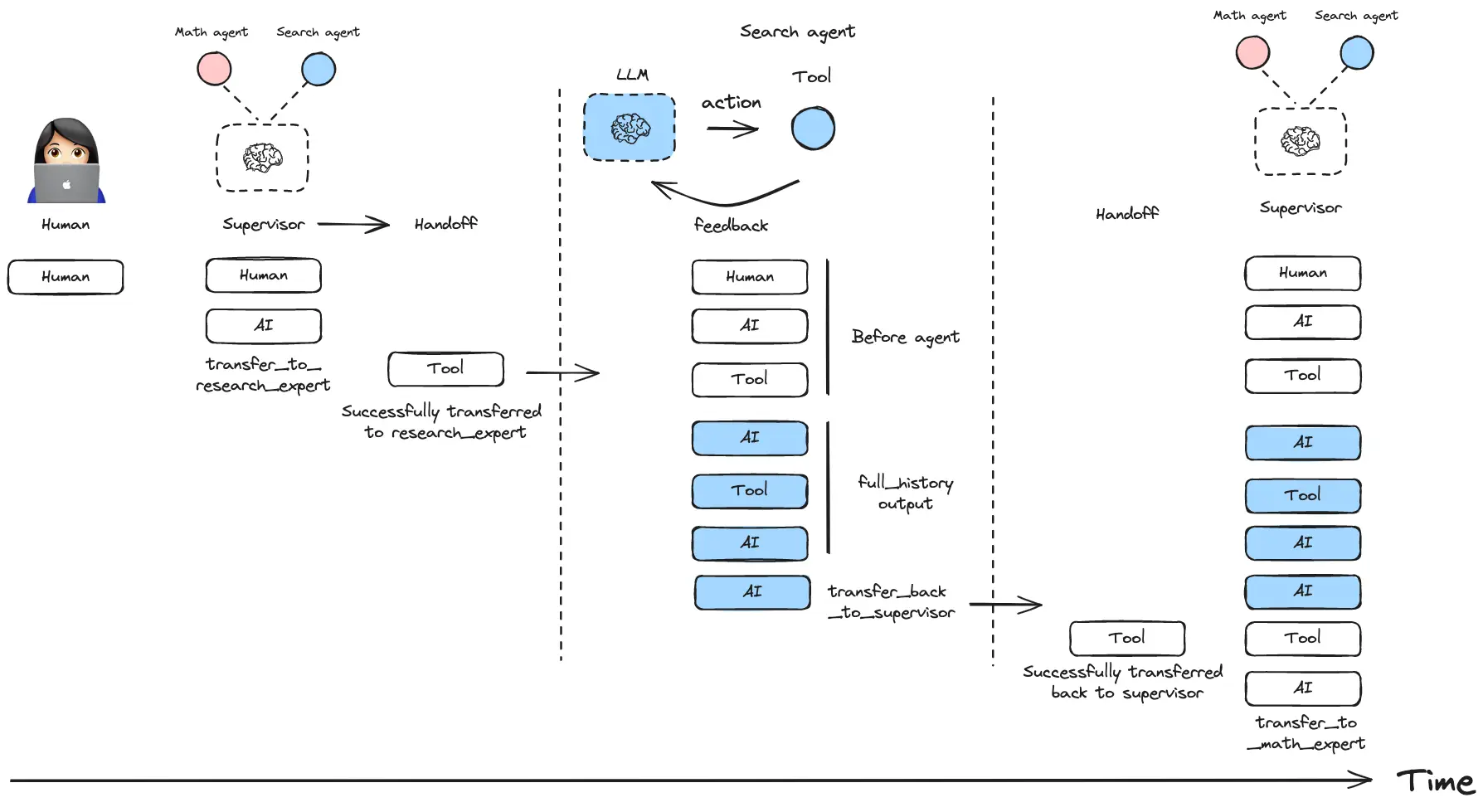

You may management how agent messages are added to the general dialog historical past of the multi-agent system:

Embrace full message historical past from an agent:

The Multi-Agent Structure

Our system consists of 5 specialised AI brokers working in a coordinated method:

- Market Information Agent (market_data_expert) – Fetches real-time inventory costs, P/E ratios, EPS, and income progress. Chargeable for fetching real-time monetary information, together with inventory costs, price-to-earnings (P/E) ratios, earnings per share (EPS), and income progress. Ensures that the system has up-to-date market information for evaluation.

- Sentiment Evaluation Agent (sentiment_expert) – Analyzes information and social media sentiment for shares. Categorizes sentiment as constructive, impartial, or destructive to evaluate the market temper towards particular shares.

- Quantitative Analysis Agent (quant_expert) – Computes inventory value developments, shifting averages, and volatility metrics. Helps detect developments, potential breakout factors, and threat ranges based mostly on previous market information.

- Funding Technique Agent (strategy_expert) – Makes use of all accessible insights to generate a Purchase/Promote/Maintain advice. Determines whether or not a inventory must be marked as a Purchase, Promote, or Maintain based mostly on calculated dangers and alternatives.

- Supervisor Agent (market_supervisor) – Manages all brokers, making certain clean job delegation and decision-making. Coordinates multi-agent interactions, displays workflow effectivity and aggregates ultimate suggestions for the person.

Palms-on Multi-Agent AI System for Monetary Market Evaluation

1. Setting Up the Atmosphere

Earlier than implementing the system, set up the mandatory dependencies:

!pip set up langgraph-supervisor langchain-openaiArrange your OpenAI API key securely:

import os

os.environ["OPENAI_API_KEY"] = "" 2. Defining Specialised Agent Features

Fetching Market Information

# 1. Fetching Market Information

def fetch_market_data(stock_symbol: str) -> dict:

"""Simulate fetching inventory market information for a given image."""

market_data = {

"AAPL": {"value": 185.22, "pe_ratio": 28.3, "eps": 6.5, "revenue_growth": 8.5},

"GOOG": {"value": 142.11, "pe_ratio": 26.1, "eps": 5.8, "revenue_growth": 7.9},

"TSLA": {"value": 220.34, "pe_ratio": 40.2, "eps": 3.5, "revenue_growth": 6.2},

}

return market_data.get(stock_symbol, {})Performing Sentiment Evaluation

# 2. Sentiment Evaluation

def analyze_sentiment(stock_symbol: str) -> dict:

"""Carry out sentiment evaluation on monetary information for a inventory."""

sentiment_scores = {

"AAPL": {"news_sentiment": "Constructive", "social_sentiment": "Impartial"},

"GOOG": {"news_sentiment": "Detrimental", "social_sentiment": "Constructive"},

"TSLA": {"news_sentiment": "Constructive", "social_sentiment": "Detrimental"},

}

return sentiment_scores.get(stock_symbol, {})Computing Quantitative Evaluation Metrics

# 3. Quantitative Evaluation

def compute_quant_metrics(stock_symbol: str) -> dict:

"""Compute SMA, EMA, and volatility for inventory."""

quant_metrics = {

"AAPL": {"sma_50": 180.5, "ema_50": 182.1, "volatility": 1.9},

"GOOG": {"sma_50": 140.8, "ema_50": 141.3, "volatility": 2.1},

"TSLA": {"sma_50": 215.7, "ema_50": 218.2, "volatility": 3.5},

}

return quant_metrics.get(stock_symbol, {})Producing Funding Suggestions

# 4. Funding Technique Determination

def investment_strategy(stock_symbol: str, market_data: dict, sentiment: dict, quant: dict) -> str:

"""Analyze information and generate purchase/promote/maintain advice."""

if not market_data or not sentiment or not quant:

return "Not sufficient information for advice."

determination = "Maintain"

if market_data["pe_ratio"] < 30 and sentiment["news_sentiment"] == "Constructive" and quant["volatility"] < 2:

determination = "Purchase"

elif market_data["pe_ratio"] > 35 or sentiment["news_sentiment"] == "Detrimental":

determination = "Promote"

return f"Beneficial Motion for {stock_symbol}: {determination}"3. Creating and Deploying Brokers

import os

from langchain_openai import ChatOpenAI

from langgraph_supervisor import create_supervisor

from langgraph.prebuilt import create_react_agent

# Initialize the Chat mannequin

mannequin = ChatOpenAI(mannequin="gpt-4o")

### --- CREATE AGENTS --- ###

# Market Information Agent

market_data_expert = create_react_agent(

mannequin=mannequin,

instruments=[fetch_market_data],

identify="market_data_expert",

immediate="You might be an skilled in inventory market information. Fetch inventory information when requested."

)

# Sentiment Evaluation Agent

sentiment_expert = create_react_agent(

mannequin=mannequin,

instruments=[analyze_sentiment],

identify="sentiment_expert",

immediate="You analyze monetary information and social media sentiment for inventory symbols."

)

# Quantitative Evaluation Agent

quant_expert = create_react_agent(

mannequin=mannequin,

instruments=[compute_quant_metrics],

identify="quant_expert",

immediate="You analyze inventory value developments, shifting averages, and volatility metrics."

)

# Funding Technique Agent

strategy_expert = create_react_agent(

mannequin=mannequin,

instruments=[investment_strategy],

identify="strategy_expert",

immediate="You make funding suggestions based mostly on market, sentiment, and quant information."

)

### --- SUPERVISOR AGENT --- ###

market_supervisor = create_supervisor(

brokers=[market_data_expert, sentiment_expert, quant_expert, strategy_expert],

mannequin=mannequin,

immediate=(

"You're a monetary market supervisor managing 4 skilled brokers: market information, sentiment, "

"quantitative evaluation, and funding technique. For inventory queries, use market_data_expert. "

"For information/social sentiment, use sentiment_expert. For inventory value evaluation, use quant_expert. "

"For ultimate funding suggestions, use strategy_expert."

)

)

# Compile into an executable workflow

app = market_supervisor.compile()4. Operating the System

### --- RUN THE SYSTEM --- ###

stock_query = {

"messages": [

{"role": "user", "content": "What is the investment recommendation for AAPL?"}

]

}

# Execute question

outcome = app.invoke(stock_query)

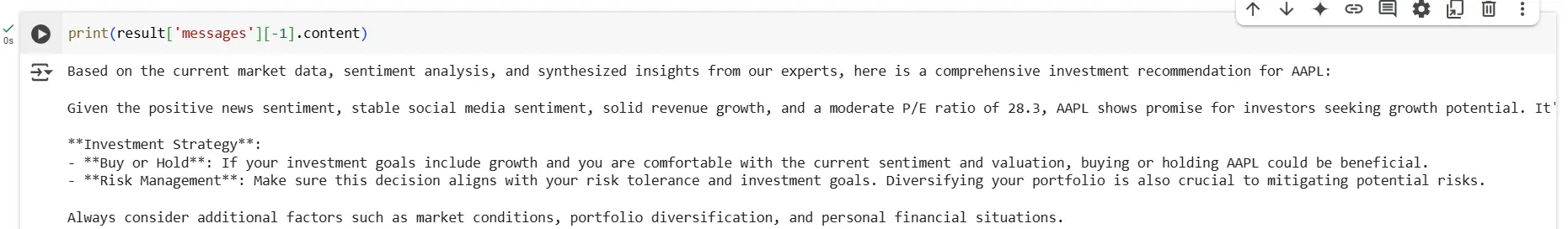

print(outcome['messages'][-1].content material)

The AI system has analyzed market information, sentiment, and technical indicators to advocate an funding motion

Future Enhancements

- Connect with Actual APIs (Yahoo Finance, Alpha Vantage) for livestock information.

- Improve Sentiment Evaluation by integrating social media monitoring.

- Develop Portfolio Administration to incorporate threat evaluation and diversification methods.

This multi-agent framework is a scalable AI resolution for monetary evaluation, able to real-time funding decision-making with minimal human intervention!

Key Takeaways

- A multi-agent AI system automates market development evaluation, sentiment analysis, and funding suggestions.

- Specialised brokers deal with market information, sentiment evaluation, quantitative metrics, and funding technique, managed by a supervisor agent.

- The system is constructed utilizing LangGraph Supervisor, defining agent features, deploying them, and working funding queries.

- The multi-agent strategy enhances modularity, scalability, automation, and accuracy in monetary decision-making.

- Integration of real-time monetary APIs, superior sentiment monitoring, and portfolio administration for a extra complete AI-powered funding system.

The media proven on this article just isn’t owned by Analytics Vidhya and is used on the Creator’s discretion.

Regularly Requested Questions

Ans. LangGraph Supervisor is a Python library that helps you create hierarchical multi-agent methods. You may outline specialised brokers and have a central supervisor orchestrate their interactions and duties.

Ans. The supervisor agent makes use of a guiding immediate and the content material of the person’s request to find out which specialised agent can fulfill the question. For instance, if a question requires fetching information, the supervisor will cross it to a market information agent. If it includes sentiment evaluation, it delegates to the sentiment evaluation agent, and so forth.

Ans. Sure. You may change the simulated features (like fetch_market_data) with precise API calls to companies equivalent to Yahoo Finance, Alpha Vantage, or some other monetary information supplier.

Ans. A multi-agent structure permits every agent to concentrate on a specialised job (e.g., market information retrieval, sentiment evaluation). This modular strategy is less complicated to scale and preserve, and you’ll reuse or change particular person brokers with out overhauling your complete system.

Ans. LangGraph Supervisor can retailer dialog historical past and agent responses. You may configure it to keep up full agent dialog transcripts or simply ultimate responses. For superior use instances, you may combine short-term or long-term reminiscence in order that brokers can check with previous interactions.