China-based purveyors of SMS phishing kits are having fun with exceptional success changing phished fee card information into cellular wallets from Apple and Google. Till just lately, the so-called “Smishing Triad” primarily impersonated toll highway operators and delivery corporations. However specialists say these teams are actually instantly focusing on clients of worldwide monetary establishments, whereas dramatically increasing their cybercrime infrastructure and assist employees.

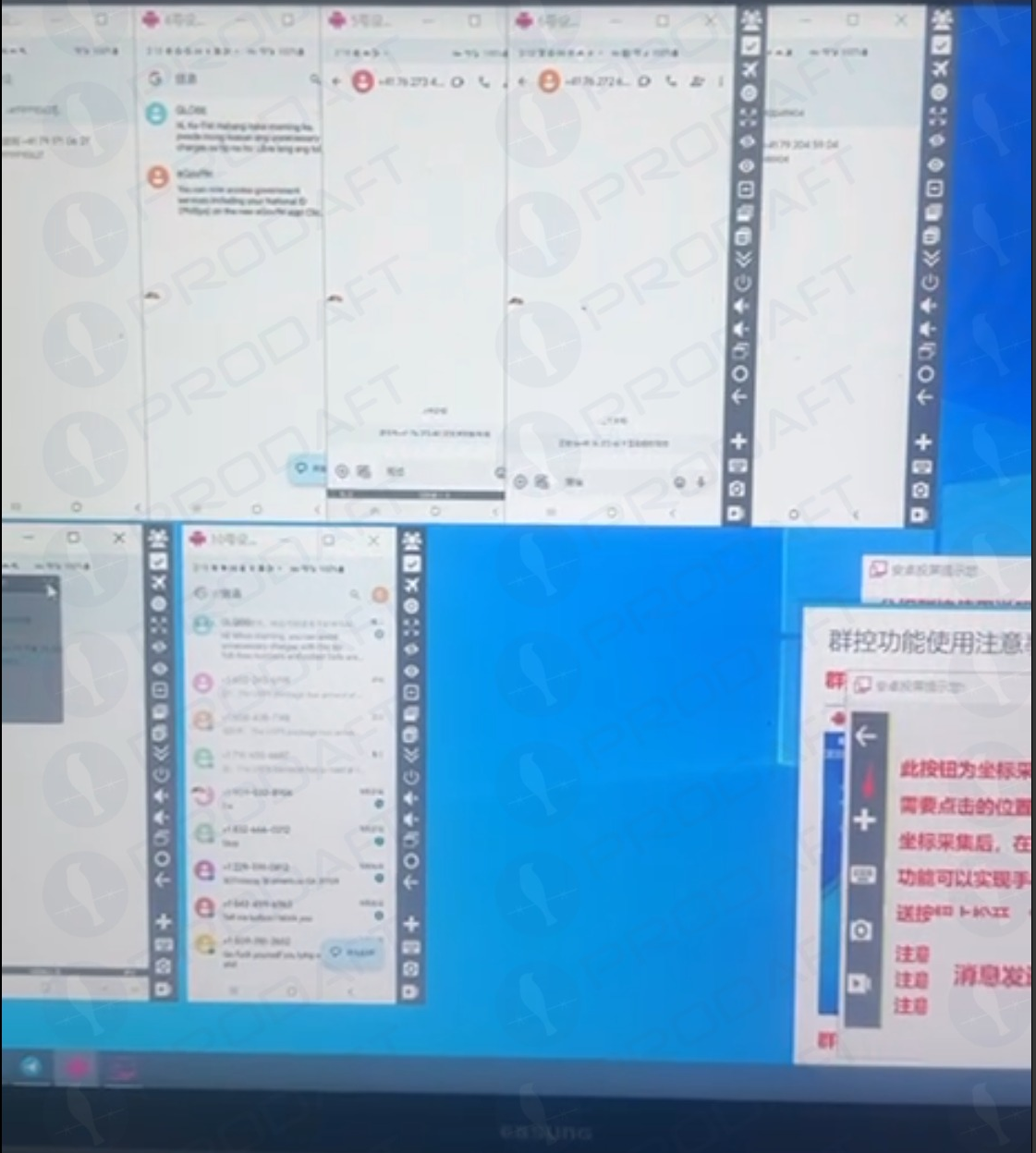

A picture of an iPhone gadget farm shared on Telegram by one of many Smishing Triad members. Picture: Prodaft.

In the event you personal a cellular gadget, the probabilities are wonderful that in some unspecified time in the future previously two years you’ve obtained no less than one immediate message that warns of a delinquent toll highway price, or a wayward bundle from the U.S. Postal Service (USPS). Those that click on the promoted hyperlink are dropped at a web site that spoofs the USPS or a neighborhood toll highway operator and asks for fee card data.

The positioning will then complain that the customer’s financial institution must “confirm” the transaction by sending a one-time code by way of SMS. In actuality, the financial institution is sending that code to the cellular quantity on file for his or her buyer as a result of the fraudsters have simply tried to enroll that sufferer’s card particulars right into a cellular pockets.

If the customer provides that one-time code, their fee card is then added to a brand new cellular pockets on an Apple or Google gadget that’s bodily managed by the phishers. The phishing gangs sometimes load a number of stolen playing cards to digital wallets on a single Apple or Android gadget, after which promote these telephones in bulk to scammers who use them for fraudulent e-commerce and tap-to-pay transactions.

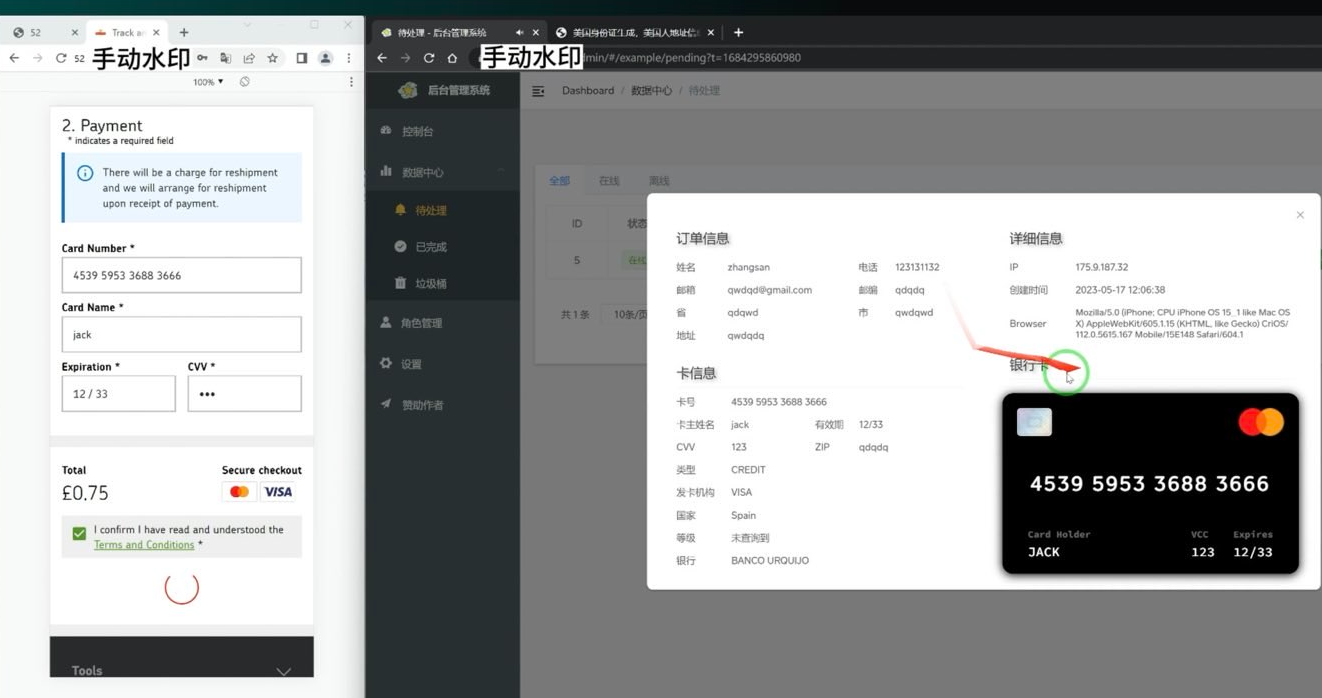

A screenshot of the executive panel for a smishing package. On the left is the (take a look at) information entered on the phishing website. On the best we are able to see the phishing package has superimposed the provided card quantity onto a picture of a fee card. When the phishing package scans that created card picture into Apple or Google Pay, it triggers the sufferer’s financial institution to ship a one-time code. Picture: Ford Merrill.

The moniker “Smishing Triad” comes from Resecurity, which was amongst the primary to report in August 2023 on the emergence of three distinct cellular phishing teams primarily based in China that appeared to share some infrastructure and modern phishing methods. However it’s a little bit of a misnomer as a result of the phishing lures blasted out by these teams aren’t SMS or textual content messages within the standard sense.

Fairly, they’re despatched by way of iMessage to Apple gadget customers, and by way of RCS on Google Android units. Thus, the missives bypass the cell phone networks completely and revel in close to one hundred pc supply fee (no less than till Apple and Google droop the spammy accounts).

In a report printed on March 24, the Swiss menace intelligence agency Prodaft detailed the fast tempo of innovation coming from the Smishing Triad, which it characterizes as a loosely federated group of Chinese language phishing-as-a-service operators with names like Darcula, Lighthouse, and the Xinxin Group.

Prodaft stated they’re seeing a major shift within the underground economic system, significantly amongst Chinese language-speaking menace actors who’ve traditionally operated within the shadows in comparison with their Russian-speaking counterparts.

“Chinese language-speaking actors are introducing modern and cost-effective techniques, enabling them to focus on bigger person bases with subtle companies,” Prodaft wrote. “Their method marks a brand new period in underground enterprise practices, emphasizing scalability and effectivity in cybercriminal operations.”

A new report from researchers on the safety agency SilentPush finds the Smishing Triad members have expanded into promoting cellular phishing kits focusing on clients of worldwide monetary establishments like CitiGroup, MasterCard, PayPal, Stripe, and Visa, in addition to banks in Canada, Latin America, Australia and the broader Asia-Pacific area.

Phishing lures from the Smishing Triad spoofing PayPal. Picture: SilentPush.

SilentPush discovered the Smishing Triad now spoofs recognizable manufacturers in a wide range of business verticals throughout no less than 121 nations and an unlimited variety of industries, together with the postal, logistics, telecommunications, transportation, finance, retail and public sectors.

Based on SilentPush, the domains utilized by the Smishing Triad are rotated steadily, with roughly 25,000 phishing domains lively throughout any 8-day interval and a majority of them sitting at two Chinese language internet hosting corporations: Tencent (AS132203) and Alibaba (AS45102).

“With practically two-thirds of all nations on the earth focused by [the] Smishing Triad, it’s protected to say they’re basically focusing on each nation with trendy infrastructure outdoors of Iran, North Korea, and Russia,” SilentPush wrote. “Our group has noticed some potential focusing on in Russia (akin to domains that talked about their nation codes), however nothing definitive sufficient to point Russia is a persistent goal. Apparently, although these are Chinese language menace actors, we’ve got seen situations of focusing on aimed toward Macau and Hong Kong, each particular administrative areas of China.”

SilentPush’s Zach Edwards stated his group discovered a vulnerability that uncovered information from one of many Smishing Triad’s phishing pages, which revealed the variety of visits every website obtained every day throughout 1000’s of phishing domains that have been lively on the time. Primarily based on that information, SilentPush estimates these phishing pages obtained properly greater than 1,000,000 visits inside a 20-day time span.

The report notes the Smishing Triad boasts it has “300+ entrance desk employees worldwide” concerned in one among their extra standard phishing kits — Lighthouse — employees that’s primarily used to assist numerous features of the group’s fraud and cash-out schemes.

The Smishing Triad members preserve their very own Chinese language-language gross sales channels on Telegram, which steadily supply movies and pictures of their employees laborious at work. A few of these photographs embody large partitions of telephones used to ship phishing messages, with human operators seated instantly in entrance of them able to obtain any time-sensitive one-time codes.

As famous in February’s story How Phished Knowledge Turns Into Apple and Google Wallets, a kind of cash-out schemes entails an Android app referred to as Z-NFC, which might relay a sound NFC transaction from one among these compromised digital wallets to anyplace on the earth. For a $500 month subscription, the client can wave their cellphone at any fee terminal that accepts Apple or Google pay, and the app will relay an NFC transaction over the Web from a stolen pockets on a cellphone in China.

Chinese language nationals have been just lately busted attempting to make use of these NFC apps to purchase high-end electronics in Singapore. And in the US, authorities in California and Tennessee arrested Chinese language nationals accused of utilizing NFC apps to fraudulently buy present playing cards from retailers.

The Prodaft researchers stated they have been capable of finding a beforehand undocumented backend administration panel for Lucid, a smishing-as-a-service operation tied to the XinXin Group. The panel included sufferer figures that recommend the smishing campaigns preserve a median success fee of roughly 5 %, with some domains receiving over 500 visits per week.

“In a single noticed occasion, a single phishing web site captured 30 bank card data from 550 sufferer interactions over a 7-day interval,” Prodaft wrote.

Prodaft’s report particulars how the Smishing Triad has achieved such success in sending their spam messages. For instance, one phishing vendor seems to ship out messages utilizing dozens of Android gadget emulators working in parallel on a single machine.

Phishers utilizing a number of virtualized Android units to orchestrate and distribute RCS-based rip-off campaigns. Picture: Prodaft.

Based on Prodaft, the menace actors first purchase cellphone numbers by numerous means together with information breaches, open-source intelligence, or bought lists from underground markets. They then exploit technical gaps in sender ID validation inside each messaging platforms.

“For iMessage, this entails creating momentary Apple IDs with impersonated show names, whereas RCS exploitation leverages service implementation inconsistencies in sender verification,” Prodaft wrote. “Message supply happens by automated platforms utilizing VoIP numbers or compromised credentials, typically deployed in exactly timed multi-wave campaigns to maximise effectiveness.

As well as, the phishing hyperlinks embedded in these messages use time-limited single-use URLs that expire or redirect primarily based on gadget fingerprinting to evade safety evaluation, they discovered.

“The economics strongly favor the attackers, as neither RCS nor iMessage messages incur per-message prices like conventional SMS, enabling high-volume campaigns at minimal operational expense,” Prodaft continued. “The overlap in templates, goal swimming pools, and techniques amongst these platforms underscores a unified menace panorama, with Chinese language-speaking actors driving innovation within the underground economic system. Their means to scale operations globally and evasion methods pose vital challenges to cybersecurity defenses.”

Ford Merrill works in safety analysis at SecAlliance, a CSIS Safety Group firm. Merrill stated he’s noticed no less than one video of a Home windows binary that wraps a Chrome executable and can be utilized to load in goal cellphone numbers and blast messages by way of RCS, iMessage, Amazon, Instagram, Fb, and WhatsApp.

“The proof we’ve noticed suggests the power for a single gadget to ship roughly 100 messages per second,” Merrill stated. “We additionally consider that there’s functionality to supply nation particular SIM playing cards in quantity that permit them to register completely different on-line accounts that require validation with particular nation codes, and even make these SIM playing cards accessible to the bodily units long-term in order that companies that depend on checks of the validity of the cellphone quantity or SIM card presence on a cellular community are thwarted.”

Consultants say this fast-growing wave of card fraud persists as a result of far too many monetary establishments nonetheless default to sending one-time codes by way of SMS for validating card enrollment in cellular wallets from Apple or Google. KrebsOnSecurity interviewed a number of safety executives at non-U.S. monetary establishments who spoke on situation of anonymity as a result of they weren’t approved to talk to the press. These banks have since finished away with SMS-based one-time codes and are actually requiring clients to log in to the financial institution’s cellular app earlier than they’ll hyperlink their card to a digital pockets.