December greetings from Fraser, Colorado (picured), Cedar Rapids, Iowa, and Kansas Metropolis, Missouri. We hope the Holidays have been restful and pleasurable for every of you, and that 2025 brings skilled and private development.

For the primary time in a very long time (11 consecutive years excluding COVID-2021), Jim won’t be attending the Client Electronics Present (CES) in Las Vegas (full program agenda right here). For these of you attending, we hope you learn our take under on the state of the patron electronics business and supply on-floor suggestions. Our thesis is that with practically $4 trillion in market capitalization, Apple is within the driver’s seat and everybody else is a passenger (and Apple has a minimal presence at CES). Extra under.

The final full Temporary (right here) generated loads of responses on two fronts: 1) from Cedar Rapids residents, previous and current, who share our fondness of the Quaker Oats Christmas tree, and a couple of) from many feedback on the way forward for the entry edge. A type of feedback which we didn’t point out in that Temporary was that the entry edge is rising as a result of some parts of conventional knowledge facilities are shrinking and localized edge processing is the product of continued processing, storage, and different technological enhancements. We predict that time, plus feedback in regards to the huge variations in electrical energy availability and costs, needs to be added to the earlier Temporary’s thesis.

Additionally, since it is a Vacation week and generally the workplace will be much less busy, listed here are two very latest discussions that we’d counsel watching/ listening to as time permits.

- Chris Penrose, former 30+ yr AT&T government and now International Head Enterprise Growth – Telco for Nvidia, on the TelcoDR podcast referred to as Telco in 20 (right here). In addition to a really fascinating software of sovereign AI (synthetic intelligence) for Indonesia, he discusses the preliminary outcomes of the Softbank subject trial (press launch right here).

- Bob Yates, who was SVP of M&A for Degree(3) Communications from 1999-2011, seems on Dan Caruso’s podcast referred to as The Bear Roars (right here) along side Dan’s upcoming guide referred to as Bandwidth: The Untold Story of Ambition, Deception, and Innovation That Formed the Web Age and the Dot-Com Increase (preorder right here on Amazon). There’s a second interview on The Bear Roads that’s equally entertaining from Stephanie Copeland of 4 Factors Capital, a long-time Denver telecom/ tech government.

Lastly, we need to notice the passing of two essential figures within the cable business since our final Temporary. Dick Parsons, who was head of Time Warner once they merged with AOL and led the corporate (and plenty of others) via turbulent waters, handed away on December 26th (New York Occasions obituary is right here). This morning, we realized via a Sunday Temporary reader that Chuck Dolan, a cable pioneer who began Cablevision and HBO, handed away at age 98 (Wall Avenue Journal obituary is right here). Each had been legends, and we’ll miss their wit and knowledge vastly.

The fortnight that was

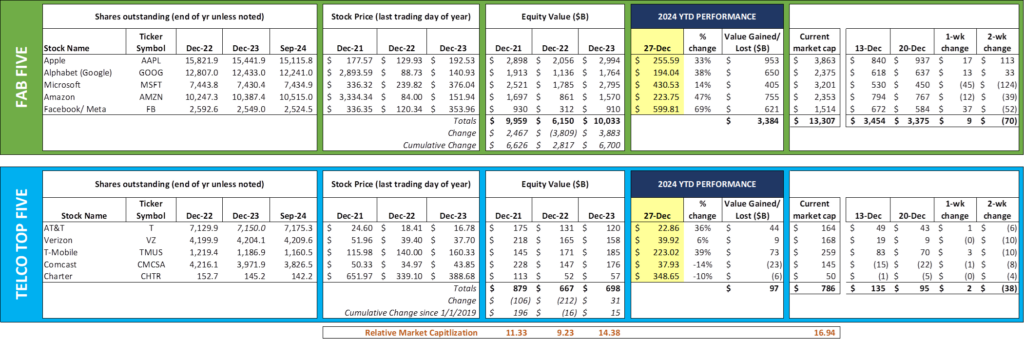

This has been a quiet week for each the Fab 5 (+$9 billion) and Telco High 5 (+$2 billion). Absent some vital rally or selloff, the Fab 5 will acquire $3.3-3.4 trillion in market capitalization in 2024, down from the $3.9 billion created in 2023. During the last six years, the Fab 5 have created ~$10 trillion in market worth. The Telco High 5, in contrast, created $100 billion in worth over the identical interval. Mentioned in a different way, for each greenback created by the Telco High 5 for the reason that starting of 2019, the Fab 5 have created $100.

For the Fab 5, 2024 will probably be generally known as the “Peak 12 months of Combating the Authorities.” Nowhere is that this extra obvious than with Mountain View-based Google/ Alphabet, who’s at the moment dealing with the prospect of divesting their browser division (Chrome) in addition to many different restrictions (Bloomberg article outlining every of these modifications right here). Regardless of the looming modifications, the inventory gained $650 billion in worth, barely greater than 2023 ($628 billion).

Alphabet will not be the one one dealing with investigation. Microsoft was simply handed a really broad request for data from the FTC (article right here); Apple (The Verge’s glorious protection right here), Amazon (partial dismissal of the FTC’s case in late September right here) and Meta (Reuters article right here on the 2026 trial date that would doubtlessly unwind their acquisition of Instagram right here) are all concerned in multi-year authorized actions.

Many have requested whether or not the investigation depth displayed over the past a number of years will proceed within the Trump administration. Whereas the precise reply won’t be identified for a number of weeks, the Legal professional Common nominee, Pam Bondi, doesn’t have the activist streak of the present lawyer basic or head of the FTC. Our guess is that activism will probably be diminished, regardless of Jeff Bezos’ possession of The Washington Publish and the complicity of Meta in suppressing data on each Fb and Instagram that would have impacted the 2020 election in addition to COVID-related issues (every of which Meta CEO Mark Zuckerburg has admitted had been poor choices in a letter to the Home Judiciary Committee – see publish right here). Extra to come back, however we predict a pendulum shift again to the center-right.

Talking of regulatory actions, AT&T obtained some excellent information final week from the Federal Communications Fee (FCC) as they authorized Ma Bell’s plan to switch conventional copper line native cellphone service with AT&T Cellphone Superior, a wi-fi native cellphone various (Bloomberg article right here). Whereas this ruling applies to a handful of houses in Oklahoma, the precedent and blueprint established by an outgoing Democrat-chaired FCC units the stage for acceleration of copper retirement, a profit for each AT&T and Verizon’s telco models.

Lastly, there was a really intriguing article on Altice in Fierce Community which featured a quote by Nate Edwards (AT&T, Lumen, now Altice) that cable firms may compete in opposition to new broadband rivals utilizing cell (we utterly agree) and video. His premise is that the hole between streaming and linear broadcast programs is narrowing, and that bundling broadband, video and cell might be an efficient cudgel to firms comparable to Frontier (who could have FiOS linear TV providing after their merger with Verizon is authorized) and upstart FTTH suppliers.

Whereas the double-play (broadband + wi-fi) is smart (see the final full Temporary right here on how we expect it’ll affect AT&T), the incorporation of video as a important bundle part is an actual headscratcher. Content material creators comparable to Amazon, Netflix, and Apple are writing large checks. Comcast and Warner Bros. Discovery are additionally segregating their linear channels as part of a plan to (doubtlessly, in WBD’s case) spin or promote these models. Linear TV served because the content material aggregator for many years, however digital aggregators (together with Xumo, the brand new video platform for Altice) are taking on. We predict that Nate’s feedback may assist Altice with sure segments, and positively will assist cut back the substantial churn Altice has skilled, however linear video is at finest a distant third half to what will probably be a broadband+wi-fi play.

CES preview—AI helps however doesn’t remake the patron electronics business

There will probably be loads of dialogue on the upcoming Client Electronics Present about how synthetic intelligence will remake the business. “Mix a superior mass market giant language mannequin (LLM) with first rate {hardware} specs and the business construction will basically change” is the favored thought.

Whereas we agree that AI will probably be a robust pressure and drive handset upgrades because it turns into an indispensable a part of society, it doesn’t upend the present client electronics construction which is dominated by Apple. As we stated in our opening feedback, the Cupertino large, with practically $4 trillion in market capitalization, has essentially the most to lose if AI proves to be revolutionary, they usually have the steadiness sheet and market share to make sure that any developments profit the iPhone enterprise mannequin.

Whereas we now have not mentioned this shortly, listed here are three issues we expect has made Apple profitable for the reason that launch of the Macintosh in 1984:

- Being as tightly built-in (closed) as doable. From the start of the corporate, software program integration into {hardware} has been tightly managed. Whereas many causes are cited (together with safety, effectivity, person expertise and price), the consequence is identical: Apple views their product as a mix of {hardware} and software program. We don’t suppose that basis will crumble due to a wave of AI apps.

- Creating merchandise that may be simply marketed. Apple turned computing into one thing that was “cool” within the Eighties and reinvented the music business in 2000s with the launch of iTunes and the iPod. The phrase “A thousand songs in your pocket” nonetheless stands as some of the highly effective product tag traces in client electronics historical past. The iPhone turned Apple into a world aspirational model and compelled Apple to work with a whole lot of wi-fi carriers working a myriad of networks throughout dozens of spectrum bands. They eliminated community compatibility as a barrier to buy – no small feat.

- They weren’t _________. Within the early days, that clean was crammed by Microsoft (queue the Mac vs PC advertisements). As their market management has grown, overtly direct comparisons to particular firms (and even the Android working system) have light into the background. We see T-Cell’s “Challenger to Champion” mantra as an try to comply with Apple’s transition.

There are lots of extra elements to Apple’s success that we shouldn’t have time to debate on this column, a few of that are immediately attributable to Tim Prepare dinner. However the three talked about above, mixed with the traits of profitable giant language fashions, lead us to consider that Apple is finest positioned from a product perspective to make the most of AI’s advantages. Right here’s why:

- Apple singularly has the aptitude to introduce localized AI fashions which are materially extra responsive and personalised than another firm. We shouldn’t have the precise statistic however could make an informed guess that no less than 1 / 4 of the said capability of an iPhone 16 goes unutilized throughout the lifetime of a mean iPhone person. What may Apple do with 30-60-90-120 GB of native reminiscence? Lots. Think about that the complete Oxford English dictionary consumes slightly below 600 MB of capability. And, due to their tight integration of iOS and the iPhone {hardware}, localized AI will probably be environment friendly and responsive.

- Apple, via Siri, has already been educated to reply to questions in 22 languages (and rising). The iPhone, per this latest Bloomberg interview with CEO Tim Prepare dinner, launched the corporate to a whole lot of thousands and thousands of latest customers throughout the globe. Siri, now barely greater than a decade outdated, has been bettering its syntax and dialect. It is probably not nearly as good as another assistants, however it’s the most ubiquitous. With elevated AI utilization, Siri’s voice recognition will enhance sooner than others. We began to see a few of the enhancements to Siri within the newest iOS launch (Voice Management deep dive from Means Web right here). Warts and all, Apple would fairly have a educated assistant than begin from scratch.

- Apple has a loyal and huge developer neighborhood. We predict that is essentially the most important factor for the patron market. Native processing (with assist for extra complicated queries from OpenAI and different LLMs), together with a world addressable market improves the financial alternative for builders. In consequence, Apple Intelligence turns into a number one LLM practically in a single day.

Apple’s problem will not be from AI itself, however from the embedded base of connecting units that shouldn’t have related processing capabilities. TVs are getting cheaper however not smarter – the intelligence is coming from peripheral units like Xumo, Apple TV, Hearth, Roku, and others (and every of those platforms has very completely different improvement roadmaps). What if the peripheral had been embedded in a brand new, smarter show? We are able to’t assist however suppose that Cupertino has been pondering lots about show consistency, and a whole rethinking of how we view content material is simply too large of a chance for Apple to disregard.

Current reviews would additionally counsel that Apple is severely contemplating a competitor to Amazon’s Ring and Google’s Nest franchises. Simply earlier than the Christmas Vacation, Mark Gurman of Bloomberg reported that Apple is contemplating a six-inch show that will combine facial recognition (presumably via one’s Apple ID) into good locks. This sounds small however would firmly tie iOS to the house. One may simply see an integration of Apple CarPlay to storage door opening or paying for occasion parking. Whereas it is probably not a big line of enterprise, a sensible door additional cements the worth of Apple to its embedded base.

Backside line: CES continues to evolve as expertise advances. Apple lacks some important parts of the in-home electronics expertise (e.g., PlayStation or Xbox equal; house home equipment like LG and Samsung), however the firm influences the patron electronics business greater than another. Not like different {hardware} firms which deal with producing right this moment’s expertise cheaper, Apple creates differentiation via software program integration. This fusion creates a excessive barrier to entry and supplies a really robust argument for continued market capitalization acceleration. Quite than making a extremely disruptive and disintermediating setting, AI really makes Apple’s management stronger.

That’s it for this week. We are going to dig into earnings drivers in our subsequent full Temporary (January 12). Till then, if in case you have associates who want to be on the e-mail distribution, please have them ship an e mail to sundaybrief@gmail.com and we’ll embrace them on the checklist (or they’ll join immediately via the web site).

Lastly – go Davidson Faculty Basketball and Kansas Metropolis Chiefs!

Vital disclosure: The opinions expressed in The Sunday Temporary are these of Jim Patterson and Patterson Advisory Group, LLC, and don’t replicate these of CellSite Options, LLC, or Fort Level Capital.