In Heidelberg, Germany, it was enterprise as typical.

The polymer manufacturing line was pushing out supplies for packaging and postage. The service bureau arm of the enterprise continued to offer printed elements. Up the highway in Frankfurt, public-facing workers had been making connections, selling merchandise and highlighting utility success tales.

Is that piquing your curiosity? Most likely not. It’s the identical few days any AM options supplier can anticipate as half the crew travels to an business commerce present and the opposite half holds down the fort.

However simply because Ahead AM was procuring leads at Formnext and fulfilling shopper orders again residence, it doesn’t imply all was properly. Lower than 5 months after carving the corporate out of BASF, the Ahead AM administration crew had been submitting for insolvency.

The corporate may need been presenting calmly in Frankfurt, however 50 miles away, there cannot have been the identical composure. For the companies that depend on Ahead AM’s supplies merchandise or its Sculpteo service providing, there actually wouldn’t have been.

The way forward for one in all AM’s main options suppliers was doubtful as insolvency proceedings had been formally introduced on November 26. And although Ahead AM’s management defined it hoped to restructure the enterprise and set it up for long-term success, there have been many questions left unanswered.

Final month, TCT spoke solely to CEO Martin Again to get some perception on what’s happening at Ahead AM, and what would possibly come subsequent.

Leaping in

However first, some background.

BASF’s additive manufacturing enterprise was formally stood up in 2017, with the Ahead AM model being launched two years later. Alongside the best way, Advanc3D Supplies, Setup Performances SAS and Sculpteo had been acquired, with a slew of polymer supplies – and a few metallic filaments – being added to its product portfolio. Partnerships had been additionally established with a number of polymer AM machine OEMs, together with Stratasys, Nexa3D, Photocentric and Farsoon.

Although BASF was among the many first of a number of chemical giants to step into the AM market with an official enterprise unit, by 2024 the corporate was able to slender its deal with ‘core companies.’ By now, it was felt that Ahead AM had reached a stage of maturity that would see it stand by itself two toes, spinning out as an unbiased entity and turning into a extra agile enterprise because it moved, properly, ahead.

Managing Director Again, supported by a number of traders, thus moved to accumulate the enterprise, in addition to Sculpteo, from BASF. The plan was to proceed a lot of the great work began inside BASF, constructing on a constant 30% annual development charge, and offering new options to the market by harnessing a 90-strong household of IP that consists of greater than 400 patents.

It was a daring step to make with the volatility in the remainder of the AM market. M&A exercise was ongoing, layoffs a daily prevalence, and a number of other corporations had been submitting for chapter. Many of those situations had been occurring as a knock-on impact from different manufacturing markets, the place corporations have been unable, or unwilling, to proceed with CapEx investments and discover new methods to fabricate their merchandise. And because it stepped out by itself, there was nothing to counsel Ahead AM wouldn’t encounter the identical struggles.

However that’s to not say there wasn’t alternative as properly. As Again instructed TCT final month: “The broad business wants help and assist. We’ve got a lot must adapt Western industrial manufacturing; the business must study and undertake new methods of creating issues. That is the place we have to leap in.”

A brand new actuality

Again and his colleagues did simply that. And received off to a gradual sufficient begin.

Having thrashed out a take care of BASF, Ahead AM had possession of the Heidelberg headquarters inside days and was in a position to instantly start serving prospects with ‘the identical folks, the identical merchandise, on the identical system.’

However there have been many complexities to the deal. Sculpteo, for instance, was initially acquired by BASF New Enterprise GmbH to sit down alongside – not essentially inside – the Ahead AM enterprise, whereas work on the 90 IP households virtually actually commenced earlier than the formation of BASF’s devoted 3D printing enterprise in 2017. What Again and his crew had been doing, then, was carving out disparate companies and departments into one unbiased firm.

“It was distributed in varied areas and entities of BASF, in several kinds, so the deal was perhaps essentially the most difficult that you can think of,” Again stated. “It was a mixture of a share deal and an asset deal – a part of the enterprise was departments inside the bigger company of BASF, so we couldn’t take over the corporate with shares, we wanted to purchase out the asset, which led to a brilliant advanced state of affairs.”

There’s extra to Ahead AM than simply Heidelberg too. What Again and his colleagues had acquired was a set of belongings that made up a world enterprise serving world prospects, headquartered in Germany however with a enterprise presence in the USA and France too. The acquisition, due to this fact, wanted to obtain approval from authorities authorities in these nations to stick to International Direct Funding (FDI) guidelines.

Ahead AM had been instructed that the Committee on International Funding in the USA (CFIUS) and France’s FDI authority would approve the acquisition inside 30 to 45 days. It could take almost 4 months.

The corporate was nonetheless in a position to do enterprise in these areas, nevertheless it had disrupted its plans to obtain extra funding within the second half of 2024.

“Till we had [their approval] we couldn’t fully shut the deal, we didn’t have one carved-out enterprise,” Again defined. “That was offering an issue by way of fundraising, as a result of after we carved out the enterprise, we had a sure plan, and I wished to proceed and go for the following [investment] spherical. This has been made way more troublesome.”

It wasn’t the one spanner within the works. Ahead AM was about to really feel the consequences of macro market situations too. Ever since Again had come into the Ahead AM enterprise a few years in the past, he had identified solely development. The corporate would typically win new enterprise, help their prospects to extend the volumes of elements being additively manufactured and discover the following buy order was higher than the final.

However this yr a brand new pattern was rising. Prospects continued to buy supplies, however they did so in lesser volumes. Again says there have been two channels the place development was stunted – service bureaus and machine maker companies – particularly in Germany and Western Europe. The 30% development charge Ahead AM boasted in 2022 and 2023 will this yr solely be roughly 15% – ‘a lot much less’ than what the corporate’s pipeline had indicated firstly of the yr.

“What we noticed had been numerous delays, stops on initiatives and prospects who went out of enterprise. This hit us,” Again stated. “You’ve gotten much less income than you deliberate. You don’t have any full enterprise since you’re ready for CFIUS and FDI filings. And you’ve got restricted functionality in reacting to the brand new financial actuality.”

For Ahead AM, the brand new financial actuality is one the place many producers are seeing CapEx budgets trimmed, buy orders not being signed off and, in consequence, much less want to purchase materials merchandise from the likes of Ahead AM. In the meantime, supplies producers working out of China are providing ‘insane volumes and costs’ for supplies, undercutting the method taken by the likes of Ahead AM of ‘engineering merchandise and attempting to make them the usual in an utility.’ That latter method requires heavy funding on the entrance finish and is taken into account a long-term enterprise mannequin the place the returns come a lot additional down the observe. It’s fairly secure – ‘when you don’t make errors on the best way’ – however the problem for Ahead AM is that traders would possibly need an earlier and quicker return.

And that problem is extra pertinent now than it has ever been for the corporate.

Resolve and evolve

Whereas the beginning of November noticed Ahead AM obtain the related FDI approvals to totally full the acquisition, the impact of the delay was already being felt. By the top of the month, Ahead AM had no alternative however to use for insolvency.

Per German legislation, an organization is taken into account bancrupt if it can’t pay obligations which can be due or whether it is over-indebted and never in a position to cowl current liabilities. Ahead AM, Again says, can cowl its day-to-day prices, but when the homeowners closed the enterprise tomorrow, its belongings wouldn’t cowl its excellent monetary obligations. In consequence, Ahead AM entered a three-month preliminary insolvency section in direction of the top of November.

As soon as insolvency proceedings have been opened, an insolvency administrator is appointed to handle the debtor’s (Ahead AM) property and interact with collectors (traders, lenders, suppliers and repair suppliers) to develop a restructuring plan. The administrator is the one who will clear belongings that aren’t the property of the debtor and pay wages to workers of the debtor, however it is going to be the collectors who make the important thing selections on whether or not to wind up the enterprise or proceed. The insolvency administrator should adjust to this choice, which is normally determined by a majority vote.

Nonetheless, each Ahead AM and the insolvency administrator – Tobias Wahl, a lawyer who specialises in insolvency and restructuring legislation – have steered the enterprise is in a spot the place it ought to be capable to proceed. Wahl has been quoted as saying: “The situations for the continuation of the corporate are in place. Enterprise operations are secure, and we’re dedicated to promptly working towards a long-term restructuring answer.”

With the preliminary insolvency stage commencing in November, the rest of that month has been counted as the primary month, with December and January rounding out the interval. Ahead AM will due to this fact enter the ultimate insolvency stage on February 1st whether it is deemed to have adequate belongings to – on the very least – cowl the prices of the insolvency proceedings.

Ahead AM is utilizing the following six weeks to barter with key stakeholders and put together a plan that may protect the enterprise. Any insolvency plan will embrace element on how collectors will likely be paid again, and can possible want new funding to be pumped into the corporate. Working in direction of the implementation of that plan will then happen if the insolvency administrator’s analysis of the enterprise factors in direction of it having the ability to be restructured, however the plan will solely turn out to be efficient with a majority of collectors voting in favour of it.

Again wouldn’t be drawn on what occurs if a plan couldn’t be developed and the funding the corporate is searching for can’t be secured – there are lots of situations that would play out – however did inform TCT he’s assured an answer may be discovered.

He stated: “There are every kind of issues [that could happen] however I’m fairly assured, primarily based on the preliminary suggestions and curiosity that we’ve got, and the statements of how essential we’re for the business from prospects and rivals, that there will likely be an answer which would be the proper one for the business and for us.”

Radical pragmatism

All through the 45-minute dialog concerning Ahead AM’s precarious place, Again is calm and measured, selecting his phrases fastidiously and sustaining his perspective.

It’s perspective from the place he attracts confidence. As he defined, the insolvency proceedings haven’t come about as a result of the corporate isn’t bringing sufficient cash in. Prospects are nonetheless ordering merchandise – albeit in lesser volumes than anticipated – and Ahead AM remains to be in a position to fulfil these orders. The enterprise as it’s purported to operate is functioning.

As a substitute, it finds itself on this place as a result of it was unable to safe the funding in time to cowl its obligations, owed to delays in FDI approvals. Issues may have panned out very in a different way this yr, if not for components past the corporate’s management.

The answer for Ahead AM is now to take higher care of what it might management. Again is due to this fact setting out a technique of radical pragmatism, formidable in its targets however cautious and conservative in its strategic method.

In discussing the long-term payoff for supplies suppliers, Again expressed some frustration with the best way that the additive manufacturing business approaches utility growth with purchasers. Lots of effort and time supporting producers has gone unrewarded financially, with OEMs seeing a return solely when the producer buys a machine and supplies suppliers solely when the appliance scales over an extended time frame.

BASF, Again says, had the sources to make that course of extra palatable, however as a smaller entity, Ahead AM has a higher incentive to hurry up the time it takes for producers to undertake, apply and qualify additive manufacturing for his or her purposes.

It’s a frustration right now that this stuff can take so lengthy nevertheless it nonetheless provides promise for the long run. As time goes on, these payoffs are getting nearer for Ahead AM, which is offering Again and his colleagues with assurance as they wade by these uneven waters.

“We’ve got nice supplies, they’re out there, they’ve prospects, and plenty of of these use instances the place our supplies are certified are initially of the lifecycle,” he stated. “That is how we anticipate development. There’s a fairly secure core, and that is what makes me assured.”

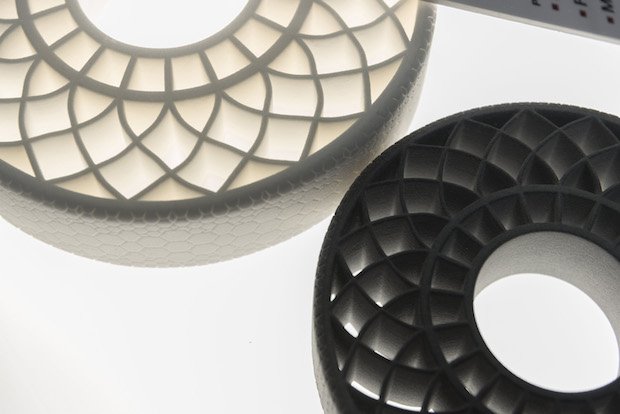

There’s additionally confidence within the Ahead AM product providing and its function within the additive manufacturing ecosystem. Again was buoyed once more when fellow Formnext attendees remarked how they’d noticed Ahead AM supplies on a big selection of cubicles on the present. Wind turbine elements, footwear insoles, injection moulding tooling, prosthetic sockets, motorsport brake elements and helmet liners have all used Ahead AM supplies within the final 12 months alone, whereas Merit3D’s now-famous manufacture of over 1 million hanger elements leaned on the Ultracur3D EDP 1006 materials.

Ahead AM has turn out to be an essential provider on this area, however that doesn’t imply there gained’t be modifications. The corporate takes delight within the progress made with its supplies product portfolio since 2017 –boasting greater than 60 supplies throughout extrusion, resin-based and powder mattress 3D printing processes – however has now steered it’s going to lean out this providing. Again instructed TCT the portfolio was maybe ‘too broad’, and it might be ‘specializing in the highest 50%’ of supplies transferring ahead.

It’s a choice being made in step with the corporate’s radical pragmatism method. Once more, Ahead AM is proud that for seven years now it has been greater than only a supplies provider, supporting prospects by utility identification and growth. However, Again says, the tempo of adoption of these purposes is ‘not giving the return on funding that the market would require.’ It means, not less than for Ahead AM, the plan is to not run earlier than it might stroll or shoot for the celebs earlier than it might fly.

Additive manufacturing, the corporate believes, will run and can attain the celebs, however to attain such radical feats the businesses on this business must embrace extra pragmatic approaches.

After current occasions, that realisation has been introduced into sharp focus in Heidelberg, Germany.

“We have to deal with the place the cash is for our prospects and what they want now’s enchancment quickly and quick,” Again completed. “Our prospects are being hit by the VUCA (volatility, uncertainty, complexity, ambiguity) world, the volatility and uncertainty are hitting huge time, and that must be the time for additive manufacturing to indicate the strengths of reacting quick to altering parameters. That is the place we need to assist, present help with our supplies and discover options which have an instantaneous influence.

“That is radical pragmatism, and I’ll adapt the organisation in direction of that, but in addition in direction of a extra humble or extra conservative understanding of how briskly adoption charges may be.”